If you’re a U.S. taxpayer with interests in foreign companies, you may have heard the term GILTI, but what exactly does it mean? The Global Intangible Low-Taxed Income (GILTI) tax is a relatively new tax provision that affects U.S. shareholders of Controlled Foreign Corporations (CFCs). Introduced by the Tax Cuts and Jobs Act (TCJA) in 2017, GILTI was designed to curb the practice of U.S. companies shifting profits to low-tax jurisdictions outside the United States. But what does that mean for you as a taxpayer, and how does GILTI affect your tax obligations?

What Is GILTI (Global Intangible Low-Taxed Income)?

GILTI stands for Global Intangible Low-Taxed Income. It refers to the profits earned by a Controlled Foreign Corporation (CFC) that exceed a certain return on tangible assets. This income is subject to U.S. tax, even though it may be earned and taxed in a foreign jurisdiction. The purpose of the GILTI provision is to prevent U.S. companies from holding profits in foreign subsidiaries where they could be subject to little or no tax, thereby avoiding U.S. taxation.

More specifically, GILTI income is the income of a CFC that exceeds a routine return on the company’s tangible assets (called Qualified Business Asset Investment, or QBAI). Essentially, it targets profits tied to intangible assets like patents, trademarks, and goodwill, which are often easier to shift across borders to low-tax jurisdictions.

The GILTI inclusion rule requires U.S. shareholders of CFCs to include GILTI in their taxable income. So, if you’re a U.S. business or individual who owns a significant stake in a CFC, any GILTI income generated by that CFC could result in U.S. tax obligations.

Who Is Subject to GILTI?

The GILTI tax is not a blanket tax on all U.S. taxpayers. Only those who are U.S. shareholders of a Controlled Foreign Corporation (CFC) are subject to this tax. A U.S. shareholder is generally defined as a person or entity that owns 10% or more of the vote or value of a CFC.

In practice, this means that the following groups of taxpayers may be subject to GILTI inclusion:

U.S. Corporations: If a U.S. corporation owns 10% or more of a CFC, it must include any GILTI income on its tax return. This could affect large multinationals that have subsidiaries in countries with lower tax rates.

U.S. Individuals: Some individuals who own a significant share (at least 10%) in a CFC could also be subject to GILTI tax for individuals. This applies to direct or indirect shareholders who are individuals rather than corporations.

If you’re a U.S. taxpayer with ownership in a foreign entity that meets these criteria, you may be required to include GILTI in your tax returns — potentially leading to additional tax liabilities.

What Is the GILTI Tax and GILTI Tax Rate?

So, what is the GILTI tax in the U.S., and how is it applied? The GILTI tax is a way for the IRS to ensure that U.S. taxpayers who own foreign subsidiaries pay taxes on certain foreign profits. It was implemented to discourage the use of tax havens and to make sure that U.S. shareholders don’t avoid paying U.S. tax by shifting income to low-tax countries.

Under the current tax law, the GILTI tax rate for corporations is set at 10.5% on the GILTI inclusion. For U.S. corporations, this rate is applied to the GILTI income generated by their foreign subsidiaries. However, this tax rate can be reduced by a deduction under Section 250, which allows U.S. corporations to deduct 50% of the GILTI they include in their taxable income, effectively lowering their rate to 10.5%. Keep in mind, these rules can change based on future tax law revisions.

For individuals, the tax rate on GILTI income can be higher, as they do not benefit from the same corporate deductions. In these cases, individuals might be subject to regular individual income tax rates, though some relief is available through elections like Section 962, which allows individuals to elect to be taxed as a corporation on their GILTI income.

Overall, the GILTI tax rate is designed to ensure that U.S. taxpayers are taxed on certain foreign earnings, but the exact rate and deductions depend on whether you’re an individual or a corporation.

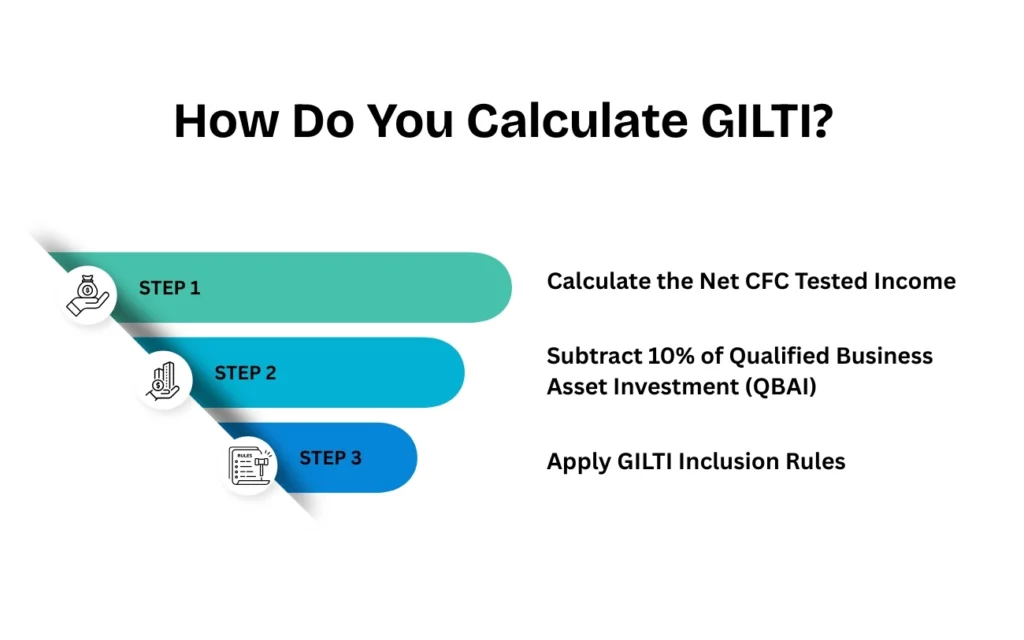

How Do You Calculate GILTI?

Calculating GILTI income can be complex, but here’s a simplified overview of how it’s done:

Step 1: Calculate the Net CFC Tested Income

First, you need to determine the total income of the Controlled Foreign Corporation (CFC) that is subject to GILTI tax. This includes income from foreign operations, minus any deductions and taxes paid to foreign countries.

Step 2: Subtract 10% of Qualified Business Asset Investment (QBAI)

The GILTI tax excludes certain income related to tangible assets. You subtract 10% of the QBAI, which represents the tangible assets (like property, plant, and equipment) owned by the CFC.

Step 3: Apply GILTI Inclusion Rules

After subtracting the QBAI, the remaining income is the GILTI income that will be subject to U.S. tax. This is the amount that U.S. shareholders must include on their U.S. tax returns.

Calculating GILTI can involve multiple steps, especially when dealing with multiple foreign subsidiaries or complex ownership structures. It’s recommended that taxpayers consult with a tax professional if they’re unsure about how to calculate their GILTI inclusion.

What Is the GILTI Deduction?

The GILTI deduction is a tax benefit introduced by the Tax Cuts and Jobs Act (TCJA) under Section 250. U.S. corporations can deduct 50% of their GILTI income, effectively reducing the GILTI tax rate. This deduction is designed to lower the overall tax burden for U.S. businesses with foreign subsidiaries. The result is a 10.5% effective tax rate on GILTI for most corporations, though this could change depending on future tax laws.

For individuals, the GILTI deduction works differently. Individuals are generally not eligible for the same 50% deduction. However, they can make an election under Section 962 to be taxed similarly to a corporation. This allows individuals to apply a corporate-style deduction, but it requires careful planning and filing.

GILTI Tax for Individuals vs. Corporations

There is a distinct difference in how corporations and individuals are taxed on GILTI income. For corporations, the tax is more favorable, thanks to the 50% deduction under Section 250, bringing their effective rate to 10.5%. On the other hand, individuals face a higher tax burden since they do not automatically qualify for the same deduction.

However, individuals can mitigate this by electing to be taxed under Section 962, which allows them to benefit from a tax rate closer to that of corporations. But this election comes with its own set of requirements and complexities, making it crucial for individuals to carefully consider their options when dealing with GILTI tax for individuals.

Key Takeaways and Compliance Considerations

When dealing with GILTI, U.S. taxpayers need to stay mindful of several key factors:

Tax Planning: Carefully plan whether to take advantage of the GILTI deduction, especially if you’re a U.S. corporation or individual with ownership in foreign entities.

Elections: Individuals may want to consider making a Section 962 election to reduce their tax liability.

Compliance: Filing GILTI correctly is essential. Ensure that your U.S. tax returns reflect all relevant GILTI income, deductions, and elections to avoid penalties.

It’s recommended that taxpayers consult a tax professional or CPA who specializes in international taxation to ensure they meet compliance requirements and optimize their GILTI-related deductions.

Summary

To recap, GILTI (Global Intangible Low-Taxed Income) is a U.S. tax provision aimed at taxing U.S. shareholders of Controlled Foreign Corporations (CFCs) on certain types of foreign income. The main points are:

- GILTI income applies to profits from foreign entities that exceed a routine return on tangible assets.

- U.S. corporations benefit from a 50% deduction on GILTI income, reducing their effective tax rate to 10.5%.

- Individuals face a higher tax rate unless they elect to be taxed under Section 962.

- It’s essential for taxpayers to calculate their GILTI inclusion and consider the available deductions and elections.

For U.S. taxpayers with international operations or investments, understanding GILTI is crucial for minimizing tax liability and staying compliant with U.S. tax laws.

FAQs

1. How does this work exactly?

Ans: GILTI taxes U.S. shareholders of Controlled Foreign Corporations (CFCs) on certain foreign profits that exceed a routine return on tangible assets, even if those profits are not brought back to the U.S.

2. What are the pros and cons of using GILTI?

Ans:

Pros: Helps prevent profit-shifting to low-tax jurisdictions and ensures U.S. companies pay tax on foreign income.

Cons: Can increase tax burdens for U.S. shareholders, particularly individuals, due to limited deductions.

3. Is GILTI taxable income?

Ans: Yes, GILTI is considered taxable income for U.S. shareholders of CFCs and must be reported on their U.S. tax returns.

4. Who is required to pay GILTI tax?

Ans: U.S. taxpayers who own 10% or more of a Controlled Foreign Corporation (CFC), including both corporations and individuals, are required to pay GILTI tax.

5 .Do I need to file additional forms for GILTI?

Ans: Yes, U.S. shareholders must file Form 5471 to report their GILTI income and other details of their foreign ownership.

6 . Can I reduce my GILTI tax liability?

Ans: Yes, U.S. corporations can use the Section 250 deduction to reduce GILTI tax, and individuals can elect under Section 962 to be taxed similarly to corporations.